John Andrew Estialbo, Staff Writer; Ursula Stancill, Staff Editor; Craig Fowler, VP-Training, Recruiting & Business Development, Pinnacle Health Group

The early 1970s witnessed expansive growth in medical schools. The Graduate Medical Education National Advisory Committee (GMENAC) and the American Medical Association (AMA) reported that there was an oversupply of physicians.(1) Due to this oversupply, a decade ago, an orthopedic surgeon in Northeast had an average income of $170,000 while a cardiologist during this same period could expect a starting salary of $200,000. Furthermore, of 2,000 practices, 80% were primary care and 20% were surgical or diagnostic.

By 2005 there were more positions than physicians. This led to physicians becoming more discerning about their career choices. For example, a gastroenterologist in the Midwest was not likely to accept an offer of less than $300,000 with a signing bonus of at least $30,000. Additionally, Interventional radiologists were offered signing bonuses as high as $80,000. Hospitals were losing around nine doctors at a time. They would source at least 50 doctors, present 30 contracts and would only receive a positive response from ten physicians. (2)

Today, 94% of healthcares CEOs are actively looking for the right fit for their facility. The majority of graduating residents immediately receive a minimum of 50 solicitations. Michael P. Broxterman, COO of Pinnacle Health Group, states that residents will only truly consider six to ten of the solicitations, while experienced physicians would consider only four.

More practices, less people

Today, 17.7% of the nation’s gross domestic product (GDP) is dedicated to the healthcare industry. (3) Given this percentage it is surprising to learn that physician recruitment has become more difficult than it was in the past. Craig Fowler, Vice President of Training and Business Development at Pinnacle Health Group, explains that, “supply and demand is one of the largest reasons why it is difficult to recruit. For example, when recruiting for internal medicine you are given a number of 90,000 as your candidate pool when in reality this number is considerably smaller due to the extremely high number of sub-specialties.” The demand for healthcare is steadily increasing while the number of future physicians remains uncertain.

The Center for Medicare and Medicaid Services reported a 50% increase in healthcare consumption. It is estimated that after nine years, one in every five dollars of the country’s GDP will be spent on healthcare and will increase by 6.2% every year. More than half a million baby boomers, including 50% of physicians, will retire and seek healthcare services by the end of 2020. (4)

| Pinnacle Health Group sampled 500 in-house recruiters and 500 physicians from across the country in a survey to assess the difficulty in physician recruitment today. The survey was conducted between June and July 2009. | |

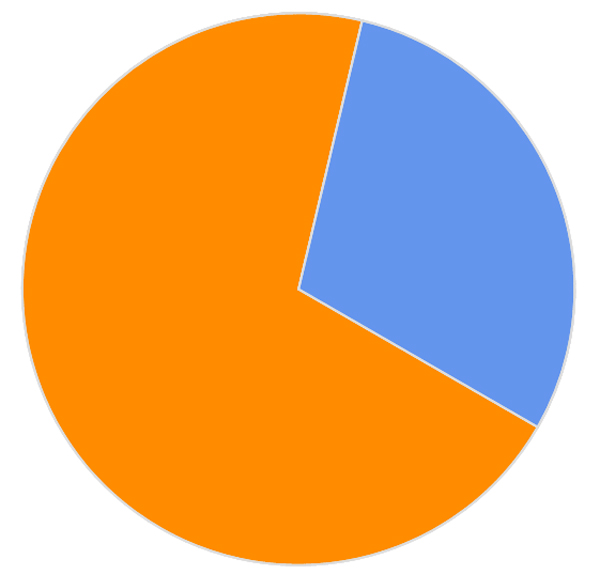

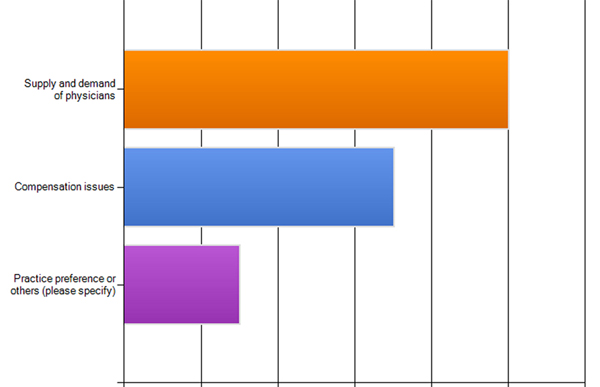

| Is it difficult to recruit physicians today? | What were the dominant factors that made recruiting challenging? |

|

|

| Yes: 70.4% No: 29.6% |

Supply and demand of physicians: 50% Compensation-related issues: 35% Other practice preferences: 15% |

Projections indicate the country needs at least 60,000 primary care specialists; The Department of Health & Human Services’ Health Resources and Services Administration projects a shortage of 55,000 sub-specialist physicians over the next 11 years. (5) According to Richard Cooper, M.D. in Health Affairs, the physician shortage could go as high as 200,000. Although, medical school applications are on the rise, a Washington DC Medical School predicts 14,000 applications; the acceptance rate is much lower. (6) Moreover, the New England Journal of Medicine warns that graduates could drop by 16% by 2020. (7)

These trends affect small to mid-sized towns profoundly. Rural areas represent around 20% of the total population; however, 50% of hospitals are in rural areas, and more than a tenth of total physicians practice in these areas. (8) Taylor county, Iowa, is without family medicine or OB/GYN physicians despite the birth rate increasing by 10%. Hospitals in Maine have more than 200 openings. Detroit, Michigan, considers neurosurgeons, endocrinologists, gastroenterologists and pediatric intensivists rare finds. Twenty-seven small Texan counties do not have a single physician causing hardship to its residents because they must drive to receive medical care.

| PHG survey (cont.) | |

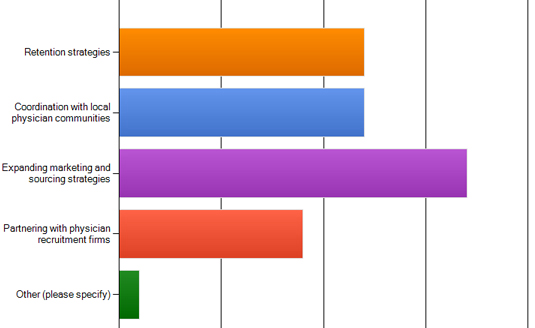

| What are you currently doing to address these challenges? |

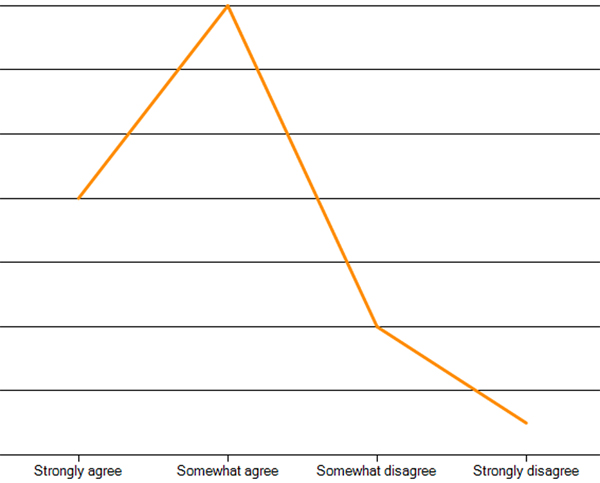

Are your current recruiting efforts working? |

|

|

| Retention strategies: 44.4% Coordination with local physician communities: 44.4% Expanding sourcing and marketing strategies: 63% Partnering with outside firms: 33.3% Others (revamping employment process): 3.7% |

Strongly agree: 29.6% Somewhat agree: 51.9% Somewhat disagree: 14.8% Strongly disagree: 3.7% |

|

Insights provided by respondents: |

|

A competitive environment in regards to compensation, incentives, scheduling, or preference to the location drives physicians to one state over another. Michigan’s economy, for instance, pushes physicians south to Indiana. Craig Fowler also comments that with the increasing percentage of younger physicians, which is almost 40%, “younger doctors now have as many available options as seasoned physicians have, and they want a more balanced quality of life, starting with a limited call schedule or none at all.”

Housing and relocation: new challenge?

There is also growing concern that the housing marketing and its implications to relocating could affect physician recruitment. Unlike now, two years ago, even ten years ago, housing issues were not a major concern. Craig Fowler explains that, “a lot of it has to do with the housing market right now. Physicians, have more expensive homes and their marketplace for selling them is thus more restricted than others. Despite a considerable interest in relocating, states such as Ohio and Michigan have a local economy that keeps them from doing so. Aside from their housing issues, these physicians are also facing a surplus of non-paying patients and a decrease in their reimbursements from insurance companies. States struggling with the recession may have difficulty in physician recruiting”.

Healthcare systems ability to help physicians with relocation expenses depends on the physician’s contract. Is it an employment model, net income guarantee, production-based incentive or a solo practice? Stark Law dictates what a healthcare system can legally do to help physicians thus restricting the options available. (9) Although some hospitals help by short selling the house and reimbursing the remaining expenses, it is imperative that more incentives, within Stark guidelines, be implemented to draw physicians to facilities.

A recent survey was conducted by Pinnacle Health Group to assess the difficulty in physician recruitment today. In a sample of 500 in-house recruiters and 500 physicians from across the country, 70.4% of respondents agreed that it is more difficult to recruit physicians today than last year. The dominant factor affecting this is supply and demand of physicians (50%). Compensation issues lagged behind at 35%. Almost 20% of those we surveyed believe that their current recruiting efforts are not as aggressive or effective. They cite issues such as the flexibility of opportunities offered and identification of practice trends and preferences.

Relieving the problem

Pinnacle’s survey also revealed that 63% of its respondents are expanding their marketing and sourcing strategies to increase communication with physicians. Half of them are implementing retention programs, and a third are reaching out by coordinating with local physician communities. However, addressing the challenges in recruitment will take more than just looking for new advertising venues.

At the federal level, the stimulus bill could provide the healthcare industry $500 million for training; 60% going to financially supporting physicians in return for signing with a practice in an urban area or underserved rural town. On the other hand, it seemed to ignore the need to fill the supply of fellows and residents. The American Association of Medical Colleges (AAMC) proposed increasing enrollments by 30% to annually replenish 5,000 doctors. They have also been lobbying accreditations and non-US based training. (10)

In 2003, 85% of healthcare groups were actively recruiting, while the remaining 15% intended to do so within 24 months. Almost half of hospitals visit residency programs to source candidates. More than 60% use network and referrals, while 74% use web-based recruitment tools to help sell their practices to physicians. (11)

According to recent surveys, web-based recruitment alone proves to be an indispensable tool for facilities to advertise their opportunities. One out of two physicians is active on the internet, and more than 66% of all online users are drawn to health-related websites. (12) Younger physicians are much easier to be sourced this way, as one out of two of them utilize the internet to search for new opportunities.

According to the Association of Staff Physician Recruiters (ASPR), as well as other surveys, annual recruitment costs for healthcare facilities could be daunting in the near future. (13) They could spend as much as a million recruiting and placing physicians. A set of interviews for five or more doctors could cost between $10,000 and $12,000.

Today’s tight economy can have a significant impact in physician recruiting. For example, placing a cardiologist in Detroit, Michigan, could take up to two years. For healthcare groups, this could be translated into at-risk annual revenue of at least $2 million that the practice will not be generating. (14)

Currently, 73% of healthcare facilities outsource some, if not all, of their recruitment campaigns to outside search firms. Half of the remaining 27% intend to do so in the future. There are currently more than 2,000 physician recruitment firms under the National Association of Physician Recruiters, a non-profit organization which provides networking tools for healthcare groups, physicians, and recruiters. A high-quality search firm can find and place a physician in three to twelve months.

Search firms excel at networking as well as marketing and should be given consideration, says Craig Fowler. Facilities must look for experience when hiring a search firm. It implies how specific they would be willing to go when addressing a client’s recruitment effort. “At Pinnacle, we could go as far as doing unique, targeted direct mail campaign for every single search. If we have four internal medicine searches, we do four different campaigns, including direct mail.”

When partnering with a firm, recruiters should be aware of how they can package and tailor sourcing campaigns to suit the needs of each individual search. (15) Moreover, success for physician recruitment firm depends on how extensive their resources are. Clients should have access to a unique network of physicians while doctors should have access to manage their careers and explore their options.

Practice preferences and the current shortfalls in the demand and supply of healthcare service have greatly affected the way physicians are recruited. Losing one physicians could cost $250,000 a month while replacing one, on the other hand, could take as long as two years. Despite these challenges, healthcare organizations should take this as an opportunity to grow, increase patient volume and provide better medical service by attracting physicians to their facilities.

ABOUT PINNACLE HEALTH GROUP

An NAPR-member, Atlanta-based Pinnacle Health Group has recently celebrated its 15th landmark year in nationally servicing healthcare groups and facilities with their search and placement requirements. With a proven track record, it is currently one of the leading physician recruitment firms, using innovative, specific sourcing techniques and proprietary technology. The founding team and specialists have accumulated more than 75 years of experience. For more information, visit our website at www.phg.com or contact us at 800-492-7771 (main) or 404-816-8831 (local).

References:

(1) Wilbur, Dwight L., MD. Future Physician Recruitment. California Medicine. December 1960, p. 365. Cited from Graduate Medical Education National Advisory Committee (GMENAC) and the American Medical Association (AMA).

(2) Health Care Demand Rising, Population Aging: The Imperative to Increase Physician Supply. Skyline News. July 23, 2007. Hursey, Tony. Measuring Recruitment Performance. Trends in Subject Recruitment 2009. March 2009, p. 2.

(3) (4) 2009 Milliman Medical Index. Milliman Research Report, Milliman Inc. May 2009; p. 7.

(5) The Physician Workforce: Projections and Research into Current Issues Affecting Supply and Demand. U.S. Department of Health and Human Services Health Resources and Services Administration Bureau of Health Professions. December 2008; p. 7.

(6) Cooper, Richard A. MD. States With More Health Care Spending Have Better-Quality Health Care: Lessons About Medicare. Health Affairs, January/February 2009; 28(1): w103-w115.

(7) How physicians search for jobs. Highlights of an independent study conducted for The New England Journal of Medicine. New England Journal of Medicine. 2008, p. 6.

(8) Parker-Hope, Tara. A Day in the Life of a Family Doctor. New York Times. August 10, 2009. Available at: http://well.blogs.nytimes.com/2009/08/10/a-day-in-the-life-of-a-family- doctor/?scp=1&sq=physician%20recruitment&st=cse. Accessed August 10, 2009.

Bertola, David. Physician recruitment a national problem. Business First of Buffalo, Western New York’s Business Newspaper. March 13, 2009. Available at: http://buffalo.bizjournals.com/buffalo/stories/2009/03/16/focus7.html. Accessed July 9, 2009. Cited from USA Today.

(9) Wilson Jr., Robert L. Trends and Issues in Physician Recruitment: An Overview of Current Trends Affecting Physician Recruitment, and Selected Legal Issues of Importance to Individuals Involved in Physician Recruitment Activities. 2009.

(10) 2008 Physician Workforce Study:Executive Summary. Massachusetts Medical Society. 2008; p. 3.

(11) Young Physicians and Their Initial Practice Preferences: A Summary of Findings from Focus Groups Conducted at U.S. Residency Programs. Center for Workforce Studies, Association of American Medical Colleges. December 2008; p. 3.

(12) Physician Practice Search Guide. National Association of Physician Recruiters. 2007; p. 13.

(13) Healthcare Industry Report: An Overview and Perspective Provided by KMPG, LLP. Journal of the Association of Staff Physician Recruiters. Spring 2009; 16:1.

(14) Hunter, Craig W.. Michigan Recruitment and Retention Network Conference. Physician Recruitment Trends and Challenges. May 19, 2008.

(15) Burley, Kim. Do you need help recruiting a partner? The Michigan Health Council Can Help! Michigan Health Council, TRIAD. Summer/Fall 2008; p. 26.

Hertz, Kenneth T. CMPE. Tips for successful physician recruitment and retention. MGMA Health Care Consulting Group, Medical Group Management Association. July 9, 2009