by Wendy Abdo, Staff Writer & Michael P. Broxterman, COO Pinnacle Health Group

This year the National Association of Physician Recruiters (NAPR) compiled and published new statistics on physician recruitment industry trends. Ninety-three search firms completed the survey for a response rate of 47 percent.

This survey is useful to recruiters and physicians alike. How so? While recruiters find the information important in determining up-and-coming trends, physicians gain valuable insights in what staffing agencies are out there, what specialties are in greater demand, what types of opportunities they can find with recruiters, as well as the overall job outlook of the healthcare industry.

Recruitment Industry Statistics

Currently there are about 769 physician recruitment firms in the United States and over 1,767 in-house recruiters. Of the 769 firms, over 300 are members of the NAPR. The current size of the medical staffing industry is $14 billion and is expected to increase 15-25 percent a year.

Participating Recruitment Agencies

The agencies that participated in the study were broken down into four sectors:

- Retained: A recruitment firm that usually requires an up-front fee or monthly fee installments from a hospital/practice before the physician is placed.

- Contingency: A recruitment firm that is not paid by the hospital or practice until a physician is placed.

- Locum Tenens: A recruitment firm that provides short-term or temporary placement of physicians.

- In-house: A department run by the medical facility itself that handles all recruitment for their own organization.

Snapshot of an Average Recruitment Firm

Using the statistics we have gathered, an average recruitment firm:

– Has three employees

– Has been in business for less than 12 years

– Makes over $400,000 in revenues

– Completes searches in five months

– Fills 81% of its searches

Recruiting Activities

While all four types of recruitment firms are listed as using the Internet, job boards, and e-mail, there were some notable differences. For instance, retained firms utilize direct mail as an important part of recruitment while contingency firms more often rely on cold calls. Locum tenens companies are reported as using all three of these activities. In addition to using Internet/job boards and e-mail for recruitment, in-house departments also make use of advertisements in popular medical journals as a means of attracting prospective candidates.

Where Recruiters Advertise

The NAPR cited websites and job boards as being the number one choice of all four types of recruitment agencies. At a distant second, was the New England Journal of Medicine. However, locum tenens agencies are listed as favoring the American Academy of Family Practice as a second source for advertising.

Sources of Placements

Where do most placements come from? That depends. Retained and contingency firms are reported to receive most of their placements from direct mail campaigns. However, retained firms also receive a great deal of leads that later place from Internet job boards; whereas, contingency firms get their placements from telephone inquiries. According to the study, locum tenens agencies get a preponderance of placements from both telephone inquiries and referrals, while in-house departments tend to get theirs from advertising and referrals.

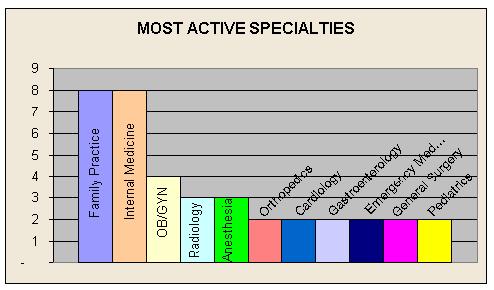

Most Active Specialties

How do you define an active specialty? There are a number of factors. First, the specialty may be growing at a faster pace than the number of available physicians. Second, the specialty may have high physician turnovers that cause an influx of opportunities in the industry. Also, larger specialties such as primary care and internal medicine have a greater volume of job openings.

What does this year’s NAPR study show? Family Practice and Internal Medicine still lead the survey as the most active specialties for 2003.

Expected Physician Shortages

According to statistics, retained, contingency, and locum tenens firms predict shortages in the fields of cardiology, gastroenterology, and radiology. In contrast, in-house and contract management companies calculated that general surgery and OB-GYN would be in short supply for the year ahead.

Job Outlook For The Healthcare Industry

The U. S. Bureau of Labor projects that healthcare service jobs will show a significant increase resulting in 2.8 million new positions by 2010.

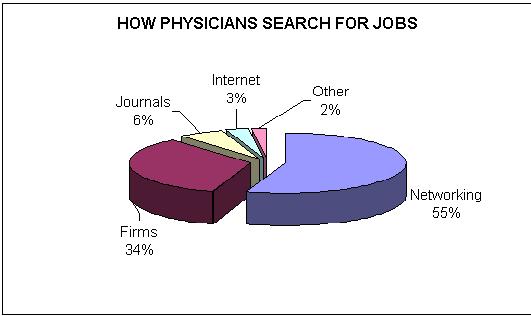

Currently, there are approximately 727,000 practicing physicians in the United States. Out of this physician pool, an estimated 8 percent or 58,160 physicians a year will be on the move. About a third or 19,774 of these physicians will use recruitment firms to help them with their job searches.

Distribution of Physicians Across The United States

Certain states have more physicians per capita than other states. The following states have the highest rates of physicians per capita:

Washington, DC

Massachusetts

New York

Maryland

Connecticut

Vermont

Rhode Island

New Jersey

Pennsylvania

Hawaii

In contrast, states that have the lowest rates of physicians per capita include:

Idaho

Mississippi

Oklahoma

Alaska

Nevada

Wyoming

Iowa

Arkansas

South Dakota

Texas

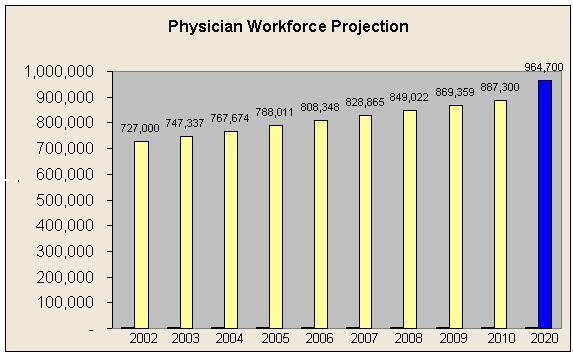

Future Projections in Physician Labor Force

Statistics from the U. S. Bureau of Labor predict that physician jobs will increase from 727,000 to 887,300 in 2010, and by 2020, the job outlook for physicians will stand at 964,700!

To give an example of increases in certain specialties, let’s look at statistics for cardiologists alone. According to the American College of Cardiology, from 1999 to 2030, the need for cardiologists is expected to rise 66 percent, and by 2050 it should increase to a whopping 93 percent. However, the actual supply of cardiologists is expected to increase by only 1 percent a year.

Possible Explanations For Increases

Exactly what is causing these numbers to rise? The following long-term demand drivers seem to signify why these changes will occur:

1) An Aging Population

2) Accelerated Early Retirement of Physicians

3) Changes in Lifestyles of Younger Doctors

4) The Rise of More Complex Treatments

5) Shifting Physician Demographics

6) Price Increases Due To High Need

7) Overall Population Increases

The expected increase in the medical staffing industry offers a positive outlook for recruitment firms. However, long-term indicators point to an imbalance in the years ahead due to increased demand for medical services combined with shortages in the physician workforce. As these predictions are realized, the industry will compensate and adapt where necessary. By keeping abreast of these changes and planning accordingly, we can ease the growing pains and facilitate progressive outcomes for the years ahead.

References:

Bowling, Jeffrey, M. National Association of Physician Recruiters. Numbers: Data and Facts that Affect Your Department and Firm. March 29, 2003.

National Association of Physician Recruiters. 2003 Physician Recruitment Industry Trends Survey. Kerr & Downs Research: 2003.