by Michael P. Broxterman, COO&

Wendy Abdo, Staff Writer – Pinnacle Health Group

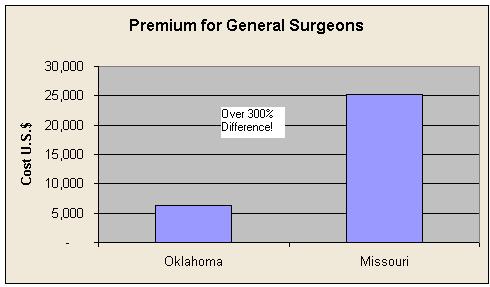

People are on edge about the sharp rise in malpractice insurance premiums. Many physicians have limited their clinical services or have even relocated to more equitable practice environments. Because of this, physicians in crisis states are concerned about whether to remain where they are or perhaps consider a move to a non-crisis state offering lower malpractice rates. To Illustrate the gap between crisis and non-crisis state premiums, we have collected the following data to serve as a snapshot cost estimate of first-year claims made premiums for a General Surgeon.

According to a leading malpractice insurance company, estimated coverage for a General Surgeon in Oklahoma based on a $1 million/$3 million limit is $6,256. In contrast, the same General Surgeon operating in Missouri with identical coverage would have to pay $25,195 for a first-year claims made premium. If this General Surgeon decided to move from Oklahoma to Missouri, he/she would be paying over 300 percent more for malpractice insurance. Another point to keep in mind is that premiums tend to double or triple over a standard five-year maturity period. Consequently, if a doctor is looking at several different employment opportunities, the cost of malpractice premiums may be instrumental in making his/her final decision. However, doctors who move across state borders are not the only ones touched by the volatile malpractice market.

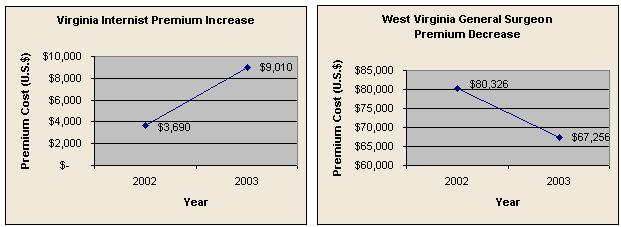

Physicians, who decide to stay where they are, have also been affected. In particular, Medical Liability Monitor has reported that Internists in Virginia have seen a 144.2 percent increase in mature claims made malpractice rates from 2002 to 2003 ($3,690 to $9,010) as shown above. But were there any rate decreases reported? Yes. In fact, West Virginia’s General Surgeons went from paying $80,326 in 2002 to $67,256 in 2003; a 16 percent decrease. According to the study, Florida rates were the highest in the country with mature claims made rates for General Surgeons topping out at a whopping $226,542.

A Gynecologist in Nebraska making $250,000 a year paying $16,194 for malpractice insurance who moves to Illinois where malpractice premiums are $147,023, will lose a mind boggling $130,829 a year! In contrast, if this doctor moved from Illinois to Nebraska, he would be keeping the $130,829 instead of paying it out in premiums. Bottom line is that if compensation does not adequately cover any premium increases, a physician should not contemplate the move. Therefore, it is important for hospitals to consider all alternative compensation methods.

So what alternatives should physicians considering job opportunities with hospitals that are located in crisis states expect? The hospital should do one or a combination of the following:

1) Agree to pay the physician’s malpractice insurance for a designated length of time,

2) provide adequate “tail” coverage for the physician,

3) agree to compensate by increasing base salary, or

4) offer a signing bonus that will cover the costs of the malpractice insurance.

Another significant factor that affects compensation is the hospital’s payor mix. If the payor mix compares favorably, this difference will help reduce the worries a physician may initially have in moving to a high premium area.

Writers of professional medical liability insurance tend to be pessimistic about current and near future malpractice rates. According to Medical Liability Monitor, 83 percent believe that more rate increases will happen in 2004. However, they do not think it will be as high as it was in recent years.

Is there light at the end of the tunnel? Yes. Regardless of these issues, national and state-level tort reform efforts should eventually stabilize the current situation. Likened to our own economy, malpractice premiums go through cycles. In almost every decade since the 1960s, a problematical malpractice situation has taken place at some point. All states now have tort reform on their legislative dockets. Results are forthcoming. In addition, public attitudes seem to favor tort reform. A recent Gallup pole indicated that 72 percent of Americans believe in limiting the dollar amount a patient can be awarded for “pain and suffering” damages.

Physicians should not be quick to rule out a job opportunity just because it is located in a state currently suffering from malpractice crisis. Even in average years, premiums will vary, sometimes considerably, from year to year, state to state, and county to county. Physicians should do their homework by comparing the differences and not the sum total. The difference in malpractice costs could easily be made up for elsewhere in the contract. As with every opportunity, there are good points and bad points. What you must concentrate on is the overall balance. If you are going to get 80 percent of what you initially wanted then chances are your decision to accept will be a good one. By keeping this in mind while considering all viable prospects, physicians can ensure they find the job opportunity that will offer the best overall benefits.

References

Medical Liability Monitor. (October 2003). Rate Report Presents State-by-State Snapshot of Changing Market. Volume 28, No. 10.

The New England Journal of Medicine. Coping With Malpractice Coverage Issues. Retrieved November 9, 2003, from

http://www.nejmjobs.org/resource_center/article_24.asp.